Introducing a new,

simple approach to

learning accounting.

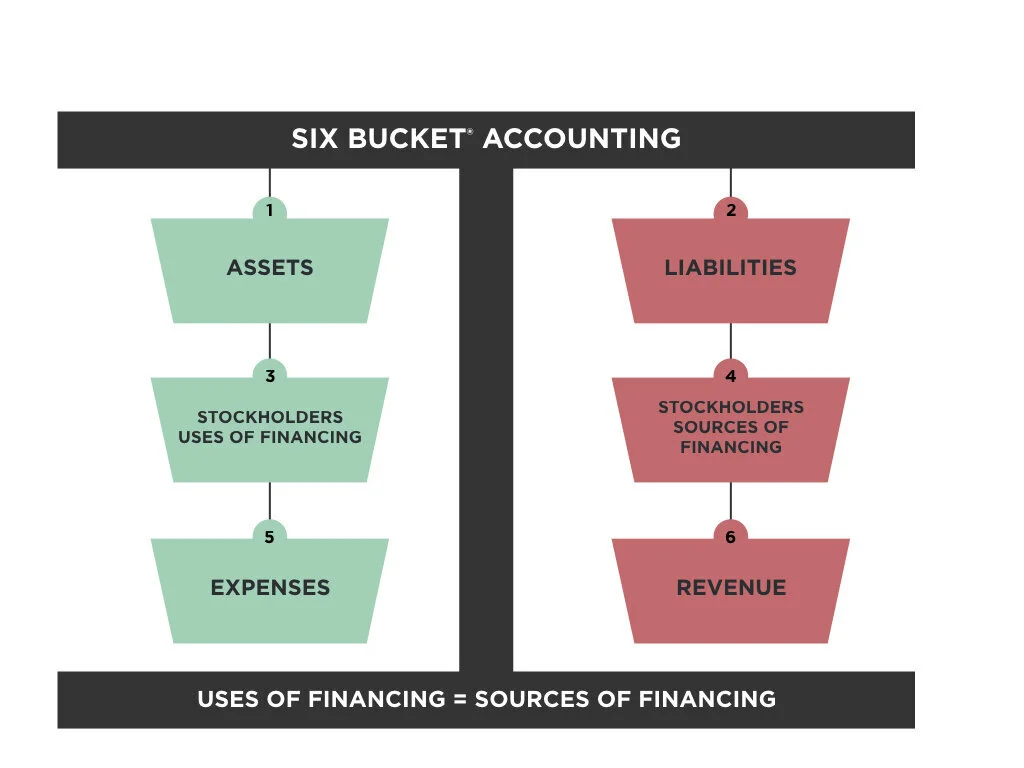

The Six Bucket™ accounting method makes it simpler than ever to teach or learn accounting.

For decades now, schools have been teaching students HOW to do accounting in a complicated and unintuitive way. The Six Bucket™ method presents a simple Uses equals Sources of financing approach to teaching. All you will need is a spreadsheet application and a desire to learn accounting.

For $79.99, you will receive the following digital illustrations:

Six Bucket™ method introduction – No Debits, Credits

Six Bucket™ method tutorial – Jill’s Business – No Debits, Credits

Six Bucket™ Introduction

In every business transaction, the Uses of financing must always equal the Sources of financing. Accounting is a structured process of recording from where financing is obtained (SOURCES) and how the financing was or is being used (USES).

BUCKET 1: ASSETS

An asset is a property which derives its value from its ability to generate future cash flows that a greater than its acquisition costs.

BUCKET 2: LIABILITIES

Amounts owed to vendors, employees, governments, financial institutions etc. for goods, services or short and long-term financing.

BUCKET 4: STOCKHOLDERS

Source of financing. Financing directly from stockholders

BUCKET 3: STOCKHOLDERS

Direct payments or obligations to stockholders.

BUCKET 6: REVENUE

The amount earned as a result of providing goods and services to customers. Revenue can also be described as an increase in assets, usually cash, and accounts receivables as the result of a sale.

BUCKET 5: EXPENSES

The portion of an asset cost that is consumed, or a cost incurred and consumed through the creation of a liability which will require the future transfer of an asset, usually cash.

Want to learn more?

The Six Bucket™ method kit includes the Six Bucket™ introduction and illustrated tutorial to teach you how to solve accounting problems in half the time as other methods!

Solidify Your Understanding with

Six Bucket™ Personal Tutorial Services

The Six Bucket™ tutorial services are for students or professionals that want to take their comprehension to the next level.

Learn how to use the Six Bucket™ directly from its creator, Clarence Coleman

Cover any accounting basics in an interactive and positive environment

Available for an individual or group sessions

Held in a digital or physical classroom setting

Pricing available upon request

About the Author

Dr. Clarence Coleman PhD CPA

Dr. Clarence Coleman has worked as a professor of Accounting at several universities. He has a PHD from the University of South Carolina, MBA from Atlanta University, and BS from Southern University.

The Six Bucket™ Accounting Method was born from Dr. Coleman’s desire to help students. When Coleman noticed that students were discouraged from the challenge of accounting courses, he created a more intuitive way to learn accounting. He would like all students to experience how easy accounting can be using his Six Bucket™method.